WHY WE NEED TO SAVE SAFE LENDING

The Government is proposing to significantly weaken Australia’s protections that exist to stop banks and other lenders from selling unsafe and unaffordable loans that cause harm to people, families and our wider economy.

These laws were introduced following the Global Financial Crisis to help level the playing field between individuals, banks and other lenders. The reforms provided critical consumer protections that deterred lenders from providing unaffordable and unsuitable loans, and offered redress for people when those laws were breached.

The strength of our lending standards is one of the reasons our economy has been able to withstand record high levels of household debt. Repealing these protections in the midst of a recession is madness.

During the US subprime loan crisis, which kickstarted the GFC, people became so over-indebted to lenders that many lost their homes and banks had to be bailed out with public funds.

Australia was not immune, with asset-based lending too common – people were being given loans when the only way to repay was to sell their home.

The GFC was the catalyst that spurred on efforts to transition Australia’s state-based consumer credit regulatory regimes into a modern national system. Responsible lending was a core element of the new national regime under the NCCP Act.

Responsible lending obligations apply to all consumer credit products including:

- Car loans

- Personal loans

- Mortgages

- Credit cards

These laws do not apply to loans that are mainly for business purposes. The laws are currently enforced by the Australian Securities and Investment Commission (ASIC).

The responsible lending obligations require lenders and brokers to:

- make reasonable inquiries about the consumer’s financial situation, and their requirements and objectives;

- take reasonable steps to verify the consumer’s financial situation; and

- make an assessment about whether the credit contract is ‘not unsuitable’ for the consumer.

It is illegal to suggest, assist or provide an unsuitable loan to a consumer.

An ‘unsuitable’ loan is one that does not meet the requirements and objectives of the borrower or is not able to be repaid without experiencing substantial hardship. An example of a “requirement” might be a fixed interest rate, whereas an “objective” might be to buy a home. The inquiries and verification required is scalable depending on the circumstances.

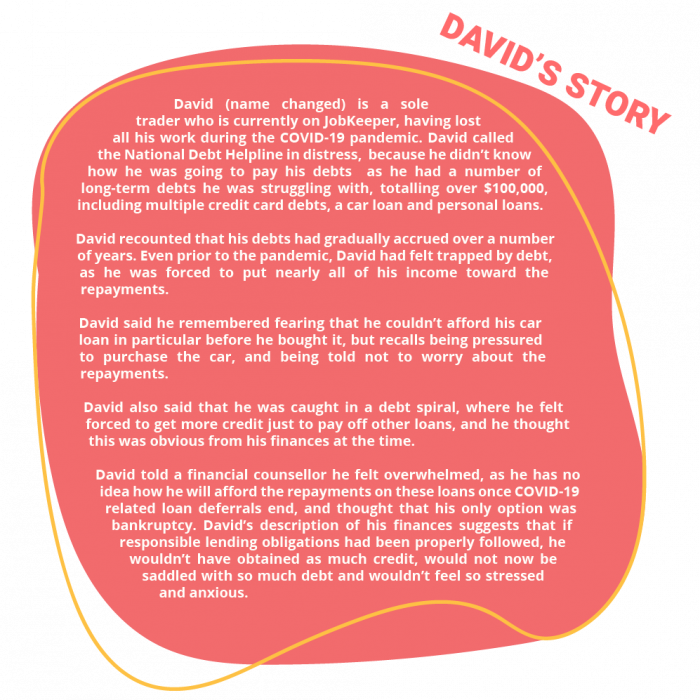

Our responsible lending laws are a preventative measure to make sure banks don’t sell loans, including credit cards, to people who can’t afford to repay them or in instances where they aren’t suitable for a person’s objectives (e.g. offering someone a $50,000 loan to buy a $17,000 car).

The proposed legislation would water down the existing protections that are in place to stop unsafe and irresponsible lending, these changes include:

- reducing people’s legal rights against lenders and brokers in relation to lending;

- removing criminal and civil penalties for irresponsible lending;

- reducing requirements for lenders and brokers to check information on loan applications;

- dismantling the ‘twin peaks’ regulatory regime for bank lending.

Borrowers would be restricted in what action they can take when lenders or brokers sell unsuitable loans.

ASIC’s enforcement powers for bank loans and penalties for wrongdoing would be removed.

These changes (if they pass Parliament) would apply to all loans sold from March 2021. The changes would not apply to payday loans or consumer leases/rent-to-buy.

The Government has released a fact sheet with details of the proposed changes, available here.

Years of misconduct exposed during the Banking Royal Commission showed that banks and brokers often place their pursuit of profit ahead of the interests of their customers.

Banks have the experience, expertise, and data to run rigorous assessments to determine whether a borrower will be able to afford a loan – advances in technology have only made this easier. Whereas, for many borrowers, a home loan might be the first and only time they’ve applied for such a significant amount of credit. Placing the primary responsibility on the borrower – whose primary interest is obtaining a loan for a home, for example – instead of the lender, creates a fundamentally imbalanced dynamic.

Removing these protections risk more Australians being saddled with harmful debt. The impact is likely to include:

- More unsuitable and unaffordable loans provided to individuals and families;

- More people with uncompensated loss from lending misconduct struggling to get back on their feet, due to less individual rights to redress;

- More instances of banks not complying with the rules and ripping off people due to APRA’s lack of focus on consumer protection;

- Increased risk that red flags for domestic violence or economic abuse will be missed as fewer requirements for lenders and brokers to inquiry into and verify a person’s financial situation, objectives and requirements;

- Lenders having less understanding of borrowers’ true financial circumstances due to estimating expenses and not verifying information in loan applications; and

- More confusing regulatory regime which is difficult for consumers and advocates to navigate, and more demand for financial counselling and other support services due to unaffordable debt.

When people start struggling to make repayments on loans, the impact can be broad and long lasting. Often people try to forgo other essential expenses, such as groceries, medicine, education or heating. The stress and anxiety experienced by people in debt affects their mental health and their family relationships. It can also lead to financial exclusion, and disempowerment.

In some cases, it will lead to bankruptcies and home repossessions.

Australia currently has the second highest debt to income ratio in the world at 186.9%.

In May 2020, ratings agency Fitch Ratings reportedly warned one of Australia’s biggest risks is the nation’s highly indebted households. It said household debt, at 186.8 per cent of disposable income, was one of the highest levels among triple A rated countries and posed “an economic and financial stability risk”.

This was reinforced by a report released in October 2020 by global financial firm, UBS, which said that removing responsible lending laws will

“increase financial stability risk over the medium term given very highly leveraged Australian households and record low [interest] rates”.

In April 2020, the Reserve Bank of Australia warned:

…the level of household debt and elevated housing prices are longstanding risks for the Australian financial system. In the period ahead, many households will find their finances under strain due to efforts to contain the virus.

Taking the handbrake off bank sales culture, and saddling people with even more debt will place our economy in a very precarious position and hinder efforts to recover from the current recession.